How much gold is required for Zakat?

Published on

5/16/2024

As Muslims, one of the most important acts of worship we must fulfill is paying Zakat. This annual charity is the Third Pillar of Islam and a religious obligation for those who have wealth above a certain threshold called the Nisab value.

The word “Zakat” literally means purification and growth. By paying Zakat, we purify our wealth and our souls from greed and selfishness. It is a means to grow spiritually while also providing support to those in need. The Quran and the teachings of Prophet Muhammad (peace be upon him) place great emphasis on Zakat as a way to achieve social welfare in society.

So how exactly is Zakat calculated when it comes to gold? And at what point does it become obligatory to pay Zakat on your gold holdings or other assets? This blog post will answer all your questions related to the minimum gold requirement for Zakat in a simple, easy-to-understand manner.

Understanding the Nisab Value

Before we dive into the specifics of gold, it’s important to understand the general rules around the Nisab value for Zakat. The Nisab represents the minimum threshold of net wealth you must possess for Zakat to become obligatory upon you.

The Nisab value is calculated based on 87.48 grams of pure gold or its cash equivalent value. So if the total net worth of all your assets (cash, gold, property, investments, etc.) equals or exceeds the value of 87.48 grams of pure gold on the annual Zakat calculation date, you are required to pay 2.5% of your total net worth as Zakat.

It’s crucial to note that the Nisab criteria apply to your total net worth and assets, not just physical gold. Even if you don’t possess any physical gold, if your total assets cross the 87.48-gram threshold, Zakat is due.

Zakat Calculation for Gold

Now let’s focus specifically on how Zakat is calculated for gold. If you possess 87.48 grams of pure physical gold or more on the annual Zakat date, you are obligated to pay 2.5% of the total value as Zakat.

For example, if you have 100 grams of 24 karats pure gold jewelry worth $5000 at current market rates, your Zakat payable would be:

Zakat = 2.5% of $5000 = $125

Similarly, if you don’t have physical gold but have cash/assets worth more than the value of 87.48 grams of gold, you would calculate your Zakat by taking 2.5% of your total net worth.

It’s important to value your gold based on the current market rate on the annual Zakat date, not the price you originally purchased it for.

Other Conditions for Zakat on Gold

Apart from meeting the Nisab threshold, there are a few other key conditions that need to be met for Zakat to become obligatory on your gold holdings:

You must have possessed the gold for at least one full lunar year (shawl). This rule applies to assets like gold, cash, stocks, and trade goods.

The gold should be more than what is used for personal/household purposes like jewelry,utensils,etc. These personal items are exempt from Zakat.

Only the excess wealth beyond your basic living requirements and outstanding debts/liabilities is subject to Zakat calculation.

Why Pay Zakat?

Paying Zakat is one of the most virtuous acts a Muslim can perform. It purifies our wealth, helps the less fortunate, and brings us closer to Allah. The Quran mentions Zakat in over 30 verses, highlighting its immense importance.

In Surah At-Tawbah, verse 103, Allah says: “Take alms from their wealth to purify them and sanctify them with it, and supplicate for them. Indeed your supplications are reassurance for them…”

Prophet Muhammad (peace be upon him) said: “Whoever pays the Zakat on his wealth with the hope of seeking Allah’s Reward and believing it to be obligatory, it will act as a purifier for him.” (Ibn Majah)

By fulfilling this obligation, we not only grow spiritually but also promote economic welfare and social justice in society. Zakat funds are utilized to support the poor, needy, those in debt, stranded travelers, and many other noble causes.

Easy Ways to Donate Zakat Online

In today’s digital age, paying your annual Zakat has become extremely convenient through trusted online donation platforms. You can easily calculate your Zakat amount and Donate Zakat Online to verified, reputable organizations with just a few clicks.

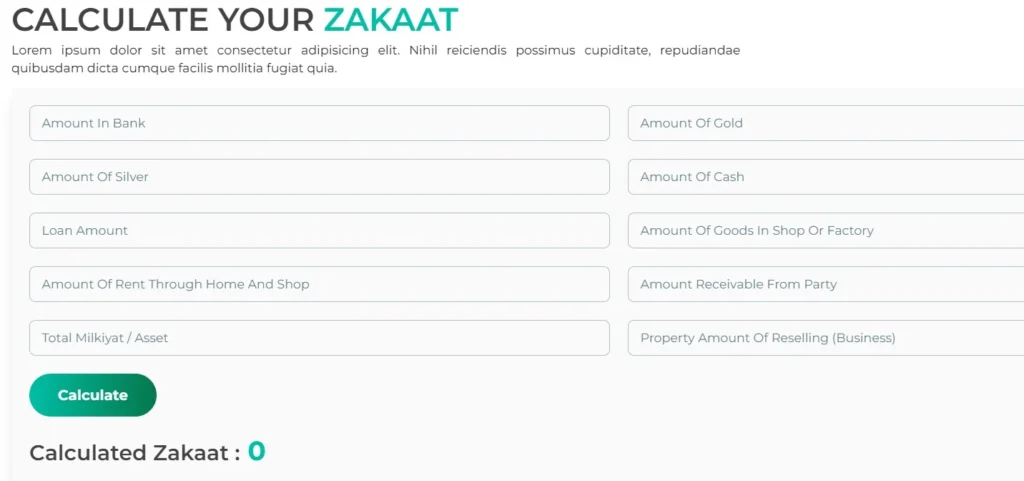

Many Islamic charity organizations and Zakat funds provide user-friendly Zakat calculators on their websites based on your net worth, jewelry value, cash savings, etc. They accept online Zakat donations via debit/credit cards, mobile wallets, and even cryptocurrency for a seamless donation experience.

By Donating Zakat Online, you can rest assured that your contributions are being utilized transparently to assist the underprivileged in regions or causes that resonate with your values. Reputable organizations provide detailed breakdowns of how your Zakat is being distributed.

In Conclusion

To sum up, the minimum amount of gold required to pay Zakat is 87.48 grams of pure gold or assets/wealth equivalent to that value. If you possess this Nisab threshold, it becomes obligatory to pay 2.5% of your total net worth as Zakat annually.

However, it’s important to calculate your Zakat carefully by considering factors like the current gold rate, the one-year holding period, excluding personal items, and deducting outstanding debts from your net worth.

Paying Zakat is a noble act that purifies our wealth, aids those in need, and strengthens the fabric of society. In the modern age, Donating Zakat Online through trusted Islamic charities and platforms makes this sacred obligation more convenient and transparent than ever before.

Remember, discharging our Zakat responsibility wholeheartedly is a means to attain the pleasure of Allah and become closer to Him. As the Quran states in Surah Al-Baqarah, verse 277: “Indeed, those who believe and do righteous deeds and establish prayer and give zakah – they will have their reward with their Lord, and there will be no fear concerning them, nor will they grieve.”

LATEST POST